Managed Pricing Services for Mid-Market Manufacturers & Distributors

Pricing outsourcing, or managed pricing services, involves partnering with an external team to handle pricing analysis, governance, and execution without creating a full internal pricing department.

The goal is to establish a repeatable pricing discipline that improves net price realization, reduces margin leakage, and drives measurable EBITDA improvement, rather than conducting a one-time pricing study.

As Thomas Nagle and Georg Müller explain in The Strategy and Tactics of Pricing, pricing is the most powerful profit lever available to a company because even small improvements in realized price flow directly to the bottom line. Research from McKinsey, Bain, and BCG consistently confirms that modest improvements in price realization can generate disproportionate gains in operating profit when governance and execution are embedded.

Managed pricing services bridge the gap between pricing theory and effective pricing discipline.

Pricing Outsourcing (Managed Pricing Services): What It Is

Pricing outsourcing delegates pricing capabilities such as data-to-decision workflows, price setting, deal guidance, governance, monitoring, and execution to an external partner who works with Sales, Finance, and executive leadership.

Unlike purchasing a pricing tool, managed pricing services provide price waterfall construction, customer and product segmentation, discount guardrails, structured deal desk support, price list management within ERP workflows, and ongoing KPI tracking, such as price realization and discount compliance.

The objective is to drive both behavioral and financial change, not just provide dashboards.

The Problem Pricing Outsourcing Solves in the Mid-Market

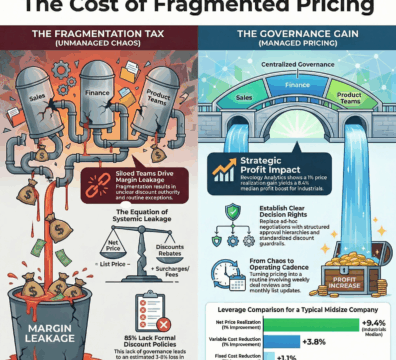

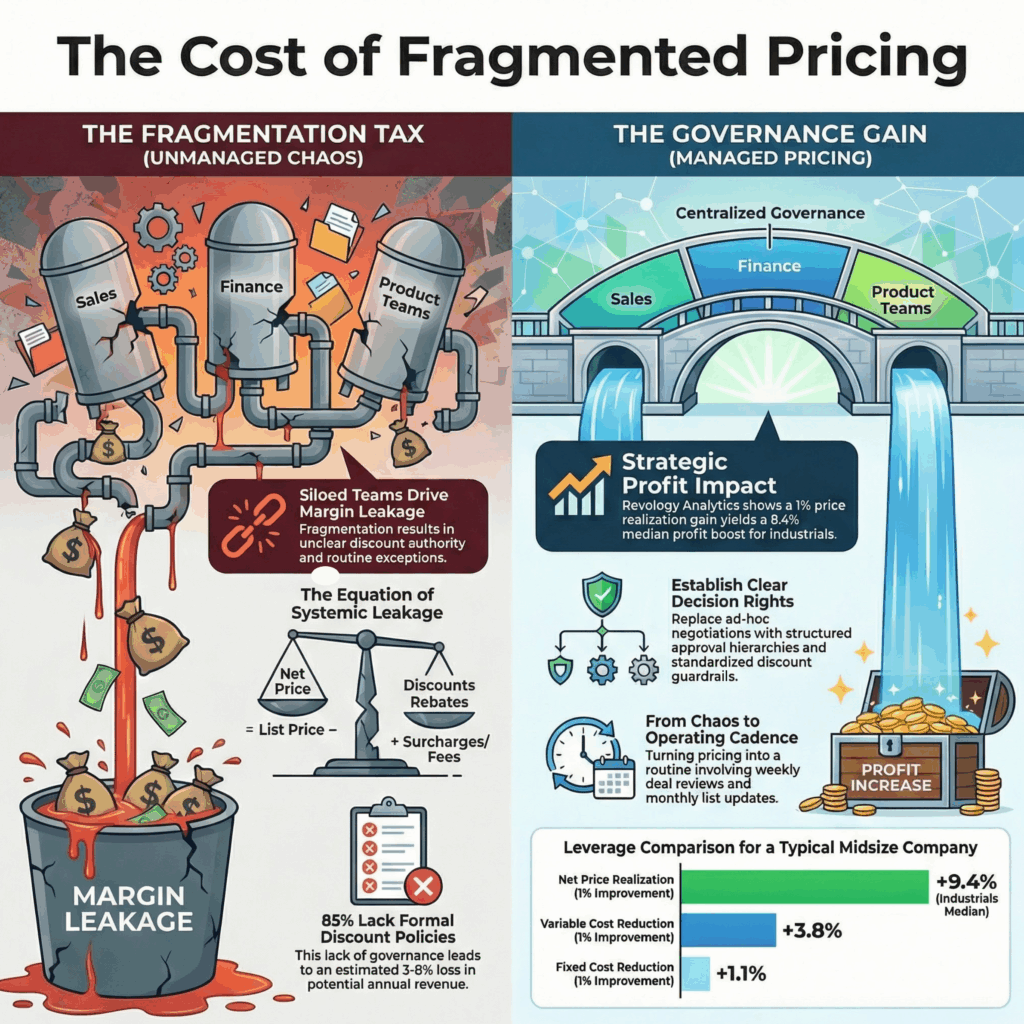

In many mid-market manufacturing and distribution organizations, pricing is fragmented. Sales negotiates, Finance reports margins, product teams maintain list prices, and ERP systems store transactions, but no one manages net price realization from start to finish.

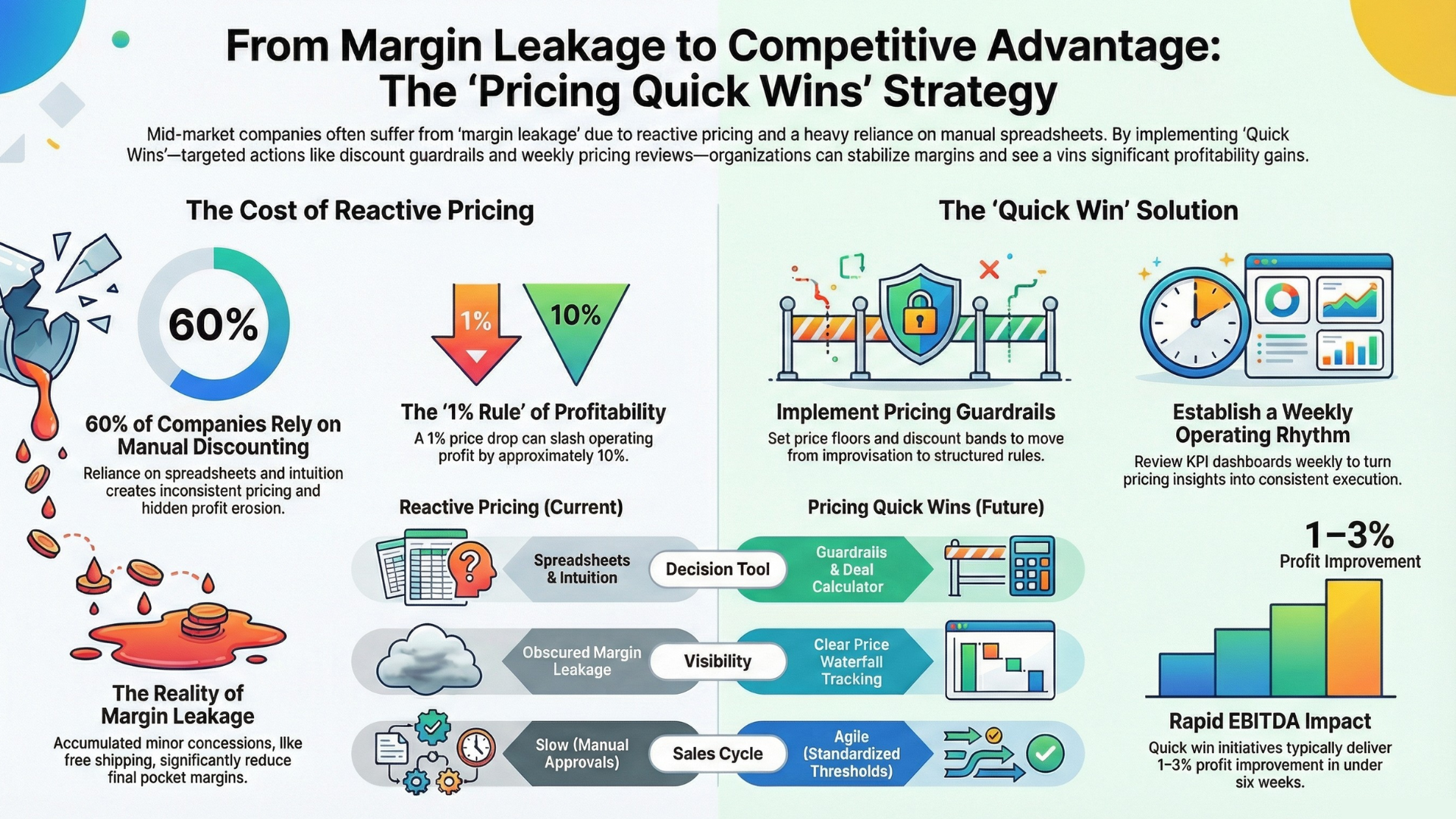

This fragmentation causes structural margin leakage. Discount authority is unclear, exceptions become routine, and rebates and credits accumulate. Price increases are often announced but not fully realized. Without a clear price waterfall, leadership cannot quantify value lost between list price and pocket margin.

Net Price = List Price − Discounts − Rebates − Credits + Surcharges/Fees

When unmanaged, this equation leads to systemic rather than occasional margin leakage.

BCG’s research on pricing governance shows that companies with structured exception management outperform peers in price realization and margin stability. The key difference is governance and cadence, not better spreadsheets.

Should You Build an Internal Pricing Team Instead?

Building an internal pricing team is a valid strategic option, but it is often more complex than anticipated.

Experienced pricing leaders require significant compensation, and many mid-market firms struggle to determine the right team size. Even with strong hires, ramp-up time can be lengthy as they learn the product portfolio, ERP workflows, and company culture. During this period, margin leakage persists.

Analytical expertise alone does not ensure organizational change. Pricing transformation requires cross-functional adoption, executive support, and disciplined governance, not just improved models.

For companies seeking rapid EBITDA improvement or uncertain about long-term pricing team structure, managed pricing services often offer a lower-risk starting point.

Internal Team and Managed Pricing Services Are Not Mutually Exclusive

The decision is not binary. Many successful companies use managed pricing services as a catalyst or accelerator.

Often, companies start with managed pricing services to quickly identify and address margin leakage. Within weeks, the price waterfall is built, discount guardrails are installed, and targeted price actions are implemented. As measurable EBITDA gains appear, leadership gains confidence in the value of pricing investment. These early gains can fund a lean internal pricing team, allowing hiring based on validated opportunity rather than aspiration.

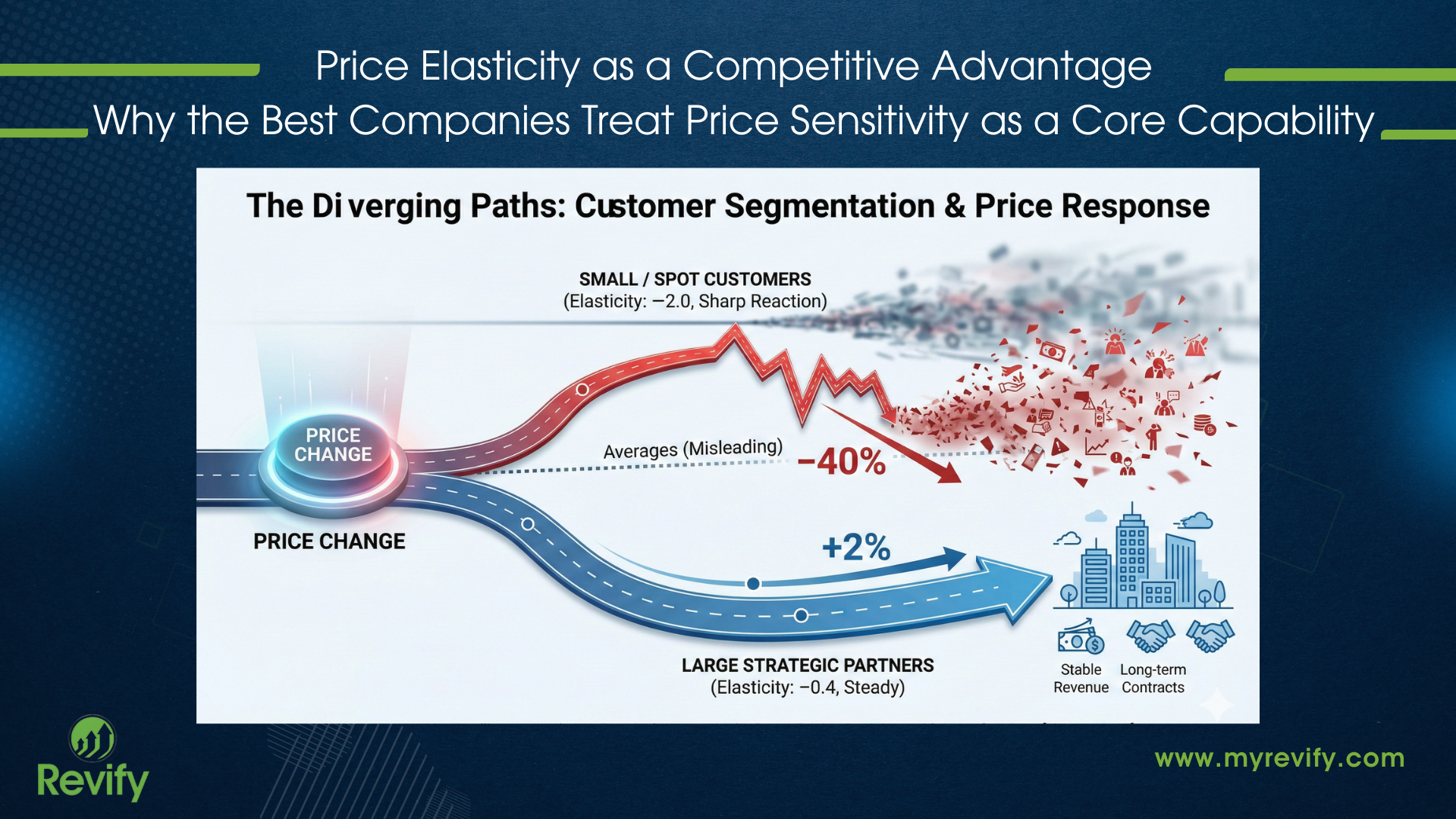

Alternatively, a company may have a pricing manager or small team that is overstretched with tactical maintenance, ERP data clean-up, and reactive sales support. High-impact initiatives such as segmentation redesign, structured price increase programs, and elasticity modeling remain underdeveloped due to limited capacity. Managed pricing services can accelerate progress by providing experienced execution and proven governance frameworks, while the internal team maintains strategic ownership. This approach can significantly shorten the pricing roadmap timeline.

In both scenarios, managed pricing services increase speed, reduce execution risk, and build trust with the executive team and Board by demonstrating real, measurable financial benefits.

What Changes When Pricing Governance Is Installed

Pricing governance clarifies decision rights, defines discount guardrails, and establishes formal exception workflows. Sales teams gain clear boundaries, leadership gains visibility into compliance, and pricing decisions become transparent and explainable.

Governance must be paired with operating cadence. Weekly deal reviews, monthly price list updates, and quarterly segmentation assessments turn pricing from episodic initiatives into a management routine.

Research from leading strategy firms consistently shows that disciplined governance and cadence—not isolated price increases—drive durable improvements in pricing performance.

Best Practices to Enable External Pricing Success

External pricing support is most effective when there is strong internal alignment.

Executive sponsorship is essential. Pricing initiatives often challenge established sales norms, and visible CEO or CFO support helps maintain discipline. Decision rights should be documented before execution to avoid ambiguity regarding discount authority.

Incentives should align with margin objectives, not just revenue. Data readiness must be addressed early, with clean invoice-level transactional data as the foundation for analysis. Adoption metrics such as discount compliance and net price realization should be tracked to ensure governance is embedded, not symbolic.

How Managed Pricing Works: Revify’s Maturity Journey

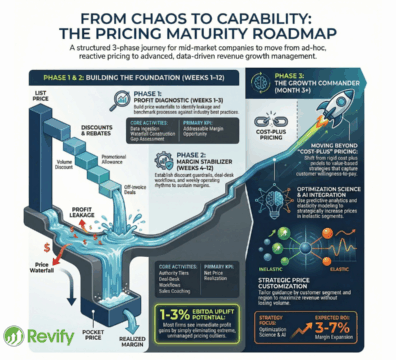

Revify Analytics delivers managed pricing services through a structured three-phase model, as described in the foundational article and aligned with the SEO framework.

The Profit Diagnostic phase establishes visibility by building the price waterfall, quantifying margin leakage, and defining prioritized pricing actions.

The Margin Stabilizer phase installs governance and executes targeted price improvements through structured guardrails and deal desk workflows.

The Growth Commander phase layers on advanced optimization, including elasticity modeling and scenario simulations, transforming pricing into a proactive revenue-growth engine.

Each phase builds lasting capability and delivers measurable financial impact.

Measuring Success in Managed Pricing Services

The most critical KPIs include:

- Net Price Realization %

- Discount Compliance %

- Price Increase Capture %

- Gross Margin %

- EBITDA Lift

Mid-market manufacturers often achieve 100–300 basis points of EBITDA improvement within the first year when pricing governance and cadence are properly embedded.

Beyond financial metrics, pricing credibility increases, sales negotiations become more structured, customers experience greater consistency, and internal alignment strengthens.

Why Engage Revify Analytics?

Revify Analytics provides enterprise-grade pricing capabilities tailored for mid-market manufacturers and distributors.

The engagement model emphasizes speed, governance installation, ERP-aligned execution, and measurable EBITDA impact. Companies gain immediate access to experienced pricing operators, eliminating the wait to build and ramp an internal team.

Clients benefit from improved sales growth, higher profitability, stronger price realization, reduced margin volatility, and greater customer satisfaction through consistent and credible pricing practices.

Pricing becomes a managed profit engine rather than a reactive negotiation process.

Start Your Profit Diagnostic

The most effective way to assess the value of outsourcing pricing is to start with a structured Profit Diagnostic. This assessment quantifies margin leakage, identifies segmentation opportunities, highlights discount variance, and creates a governance roadmap with estimated EBITDA impact.

Pricing discipline begins with visibility—and accelerates with execution.